Senior Citizens Assistance

Senior Citizens Assistance

South Florida is great place for retirees to find services that are devoted to their needs. We hope the following information will be helpful for all senior citizens living out their "Golden Years" in Sunny South Florida.

Transportation

The Volen Center provides  Door to Door service Monday through Friday in Palm Beach County. Call 561-736-3820 to register and reserve space between 9 am and 3 pm on the business day before the ride is needed. Currently, the fee is $3.00 each way. Riders must be 60 years old or older, unless they are disabled, then 18 - 59 years old are allowed.

Door to Door service Monday through Friday in Palm Beach County. Call 561-736-3820 to register and reserve space between 9 am and 3 pm on the business day before the ride is needed. Currently, the fee is $3.00 each way. Riders must be 60 years old or older, unless they are disabled, then 18 - 59 years old are allowed.

The Volen Center Shopper Hopper Schedule

Palm Tran Connection also provides transportation for seniors in Palm  Beach County. Seniors must apply individually to be able to qualify for Palm Tran Connection; and they must also have documentation from a doctor which verifies their disability. Once they qualify, Palm Tran will pick up door to door. Seniors without a disability do not qualify for service. For questions, to request a Paratransit Application, copies of our Rider's Handbook, or to book a trip, please call (561) 649-9838, 1-877-870-9849 [toll-free] or (561) 649-0683 TDD.

Beach County. Seniors must apply individually to be able to qualify for Palm Tran Connection; and they must also have documentation from a doctor which verifies their disability. Once they qualify, Palm Tran will pick up door to door. Seniors without a disability do not qualify for service. For questions, to request a Paratransit Application, copies of our Rider's Handbook, or to book a trip, please call (561) 649-9838, 1-877-870-9849 [toll-free] or (561) 649-0683 TDD.

Broward County Transit provides the Paratransit, also known as TOPS -  Transportation Options. Paratransit (TOPS) service is available during BCT's fixed-route service time, which is from early a.m. until late p.m. The one-way fare per trip is $3.50. Reservations must be made by contacting TOPS Paratransit Call Center one (1) day in advance between the hours of 8:00 am and 5:00pm. The toll-free number is 1-866-682-2258.

Transportation Options. Paratransit (TOPS) service is available during BCT's fixed-route service time, which is from early a.m. until late p.m. The one-way fare per trip is $3.50. Reservations must be made by contacting TOPS Paratransit Call Center one (1) day in advance between the hours of 8:00 am and 5:00pm. The toll-free number is 1-866-682-2258.

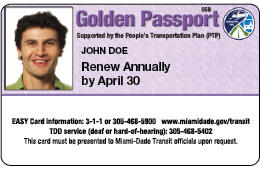

Miami-Dade County allows senior citizens 65 years and over, or a Social  Security beneficiary and are a permanent Miami-Dade resident, to ride transit free with a Golden Passport EASY Card. Call 786-469-5028 (TDD/TTY Number 305-468-5402) to request an application be mailed to you for any of Miami-Dade Transit's Discount Programs.

Security beneficiary and are a permanent Miami-Dade resident, to ride transit free with a Golden Passport EASY Card. Call 786-469-5028 (TDD/TTY Number 305-468-5402) to request an application be mailed to you for any of Miami-Dade Transit's Discount Programs.

Senior Centers

| Broward County |

Phoenix Senior Living Center III |

Coral Springs |

954-755-0757 |

| Broward County |

NE Focal Point Senior Center |

Deerfield Beach |

954-480-4449 |

| Broward County |

Senior Escort Travel |

Fort Lauderdale |

954-583-4222 |

| Broward County |

Poitier-Williams Senior Center |

Fort Lauderdale |

954-714-3500 |

| Broward County |

Memorial Senior Resource Center |

Hallandale Beach |

954-457-0501 |

| Broward County |

Meyerhoff Joseph Senior Center |

Hollywood |

954-966-9805 |

| Broward County |

Northwest Focal Point Senior Center |

Margate |

954-973-0300 |

| Broward County |

Service Agency For Senior Citizens of Broward County Inc |

Oakland Park |

954-563-8991 |

| Broward County |

Comforcare Senior Services |

Pompano Beach |

954-946-1960 |

| Broward County |

Daniel D Cantor Senior Center |

Sunrise |

954-742-2299 |

| Broward County |

United Senior Alliance |

Sunrise |

954-749-0082 |

| Miami-Dade County |

Senior Citizens Activities Center of Homestead |

Homestead |

305-245-4934 |

| Miami-Dade County |

Gesu Senior Citizen Center |

Miami |

305-374-6099 |

| Miami-Dade County |

North Miami Foundation For Senior Citizens Services |

North Miami |

305-893-1450 |

| Palm Beach County |

Sunshine Senior Services |

Boca Raton |

561-368-8101 |

| Palm Beach County |

Mae Volen Senior Center |

Boca Raton |

561-395-8920 |

| Palm Beach County |

Senior Advantages of South Florida |

Boca Raton |

561-998-2827 |

| Palm Beach County |

Mae Volen Senior Center |

Delray Beach |

561-265-3667 |

| Palm Beach County |

Senior Bridge Family |

West Palm Beach |

561-432-8370 |

Top Ten Things You Should Know about a Reverse Mortgage

Information courtesy of 1st United Funding, LLC - For more information

1. What is a Reverse Mortgage?

A reverse mortgage is a special type of home loan that lets you convert a portion of the equity in your home into cash. The equity that built up over years of home mortgage payments can be paid to you. But unlike a traditional home equity loan or second mortgage, no repayment is required until the borrower(s) no longer use the home as their principal residence or fail to meet the obligations of the mortgage.

2. Can I qualify for FHA's HECM Reverse Mortgage?

To be eligible for a FHA HECM, the FHA requires that you be a homeowner 62 years of age or older, own your home outright, or have a low mortgage balance that can be paid off at closing with proceeds from the reverse loan, and you must live in the home. You are also required to receive consumer information free or at very low cost from a HECM counselor prior to obtaining the loan.

3. Can I apply if I didn't buy my present house with FHA mortgage insurance?

Yes. It doesn't matter if you didn't buy it with an FHA-insured mortgage. Your new FHA HECM will be FHA-insured.

4. What types of homes are eligible?

To be eligible for the FHA HECM, your home must be a single family home or a 1-4 unit home with one unit occupied by the borrower. HUD-approved condominiums that meet FHA requirements are also eligible.

5. What's the difference between a Reverse Mortgage and a bank home equity loan?

With a traditional second mortgage, or a home equity line of credit, you must have sufficient income versus debt ratio to qualify for the loan, and you are required to make monthly mortgage payments. The reverse mortgage is different in that it pays you, and is available regardless of your current income. The amount you can borrow depends on your age, the current interest rate, and the appraised value of your home, sales price or FHA's mortgage limits, whichever is less. Generally, the more valuable your home is, the older you are, the lower the interest, the more you may borrow. With a HECM, you don't make monthly principal and interest payments, the lender pays you according to the payment plan you select. Like all homeowners, you still are required to pay your real estate taxes, insurance and other conventional payments like utilities. With an FHA HECM you cannot be foreclosed or forced to vacate your house because you "missed your mortgage payment."

6. When does my loan become due and payable?

A HECM loan must be repaid in full when you die or sell the home. The loan also becomes due and payable if:

- You do not pay property taxes or hazard insurance or violate other obligations.

- You permanently move to a new principal residence.

- You, or the last borrower, fail to live in the home for 12 months in a row. An example of this situation would be if you (or the last borrower) were to have a 12-month or longer stay in a nursing home.

- You allow the property to deteriorate and do not make necessary repairs.

7. Will I still have an estate that I can leave to my heirs?

When you sell your home, you or your estate will repay the cash you received from the reverse mortgage plus interest and other fees, to the lender. The remaining equity in your home, if any, belongs to you or to your heirs.

8. How much money can I get from my home?

The amount you can borrow depends on:

- Age of the youngest borrower

- Current interest rate

- Lesser of the appraised value of your home, the HECM FHA mortgage limit for your area or the sales price

- The initial Mortgage Insurance Premium (MIP) option you choose (2% HECM Standard option or .01% HECM Saver option)

You can borrow more with the HECM Standard option. Also, the more valuable your home is, the older you are, and the lower the interest rate, the more you can borrow. If there is more than one borrower, the age of the youngest borrower is used to determine the amount you can borrow.

9. Can I purchase a home with a Reverse Mortgage?

You can also use a HECM to purchase a primary residence if you are able to use cash on hand to pay the difference between the HECM proceeds and the sales price plus closing costs for the property you are purchasing.

10. How do I receive my payments?

You have five options:

- Tenure - equal monthly payments as long as at least one borrower lives and continues to occupy the property as a principal residence.

- Term - equal monthly payments for a fixed period of months selected.

- Line of Credit - unscheduled payments or installments, at times and in amounts of your choosing until the line of credit is exhausted.

- Modified Tenure - combination of line of credit with monthly payments for as long as you remain in the home.

- Modified Term - combination of line of credit plus monthly payments for a fixed period of months selected by the borrower.

Question: Borrower’s are a married couple and one is less than 62; how can they get a reverse mortgage?

Answer: HUD requires that all borrowers be 62 or older and that everyone on title must be a borrower. When there is a situation where one of the spouses is less than 62 and the qualifying spouse wants to get a reverse mortgage, the younger spouse can be removed from title at closing and the qualifying spouse can proceed with applying for a reverse mortgage. Borrowers should get the opinion of their own attorney or counsel prior to proceeding.

Living Trusts

Created while you are alive, a revocable living trust lets you control the distribution of your estate. Ownership of your property and assets is transferred into the trust. You can serve as trustee or you can appoint another to serve as trustee. If you serve as trustee, you must appoint a successor to serve as trustee upon your death.

Properly drafted and executed, a revocable living trust can avoid probate and delays as the trust owns the assets not the deceased. Consult with your attorney and/or CPA before deciding if a revocable living trust is the right choice for you.

Advantages to a Living Trust Holding Title

- A husband and wife can establish a joint revocable living trust.

- While the trustor serves as a trustee or a co-trustee, a separate tax return is not required for the trust.

- The revocable living trust allows the trustee to buy, sell and finance assets just as before.

- In the event of incapacitation, management of the living trust passes to the successor trustee without the necessity of a court-appointed conservator.

- The living trust can be cancelled or changed at any time before death or incapacitation.

- Probate - including multi-state probate - is avoided when assets are held in a living trust. (Often probate takes 9 to 12 months.)

- Privacy. When a decedent dies with a living trust, the provisions of that trust usually do not become public.

- Litigation is discouraged by a living trust.

- A married couple with a living trust can reduce or eliminate federal estate taxes by setting up an Exemption Trust. While both are alive the assets remain in the revocable living trust. Upon the death of a spouse, the trust is split into two trusts: the survivors trust and an exemption trust. (For tax purposes, the surviving spouse and the exemption trust are two separate taxpayers.)

Disadvantages of a Living Trust

- A living trust will cost more to set-up than an estate plan with only a will.

- A trust agreement with a new will must be set-up.

- Transferring assets into the living trust will require paperwork and incur costs not encountered with a less elaborate estate plan.

- Handling an Exemption Trust may require extra effort from the surviving spouse.

- Some lenders may require property held in a living trust be removed from the living trust to refinance the property.

|

Common Terms

Trustor: Creates the revocable living trust and transfers major assets into it. (A husband and wife can have a joint living trust or each can have their own living trust.)

Trustee: Manages the living trust's assets.

Beneficiary: Receives the assets of the living trust.

Initially the trustor, trustee and beneficiary are the same person(s). | |